Press Releases

Hamburg, January 10, 2026

- EOS Group receives EcoVadis Gold Medal after Bronze in the past year

- Award recognizes significant progress in the company's global sustainability commitment, showcasing its strong ESG performance

- EOS ranks in the top 3 % of companies in its industry and the top 5% worldwide, as assessed by EcoVadis

The EOS Group receives the EcoVadis Gold Medal, marking a significant improvement in its sustainability performance. This recognition follows the Bronze Medal and highlights the company's continuous progress and strengthened commitment to Environmental, Social, and Governance (ESG) principles.

Recognition for sustainability performance

The EcoVadis Gold Medal, awarded to the top 5% of organizations assessed by EcoVadis, underscores the quality of the EOS Group's excellent sustainability management system. According to EcoVadis, this places EOS among the top 3% of companies in its industry (Collection Agencies & Credit Bureaus) and among the top 5% worldwide.

Marwin Ramcke, Chairman of the EOS Group's Board of Directors: "Progressing from Bronze to Gold in just one year is a fantastic achievement that demonstrates the success of our sustainability strategy. This Gold Medal is a recognition of the hard work of our entire team and motivates us enormously to continue pursuing our path of sustainable corporate governance and exceeding our standards."

About EcoVadis

EcoVadis is a globally leading provider of business sustainability ratings. Since its founding in 2007, EcoVadis has evaluated over 150,000 companies.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of the Otto Group.

For more information on the EOS Group, please go to: eos-solutions.com

Hamburg, Germany, Aug 13, 2025

- EOS Consolidated achieves successful result in financial year 2024/25 (EBITDA of EUR 460.8 million)

- Key success factors are high investments in debt purchases and strong operational performance

- Top ESG ratings: For the second year in a row, Morningstar Sustainalytics recognizes EOS as "Top Rated Industry" and "Top Rated Regional" (Consumer Finance sector), additionally the EcoVadis Bronze Medal

The EOS Group, a company of the Otto Group, recorded an excellent result in the financial year 2024/25. With an operating result (EBITDA) of EUR 460.8 million, the EOS Consolidated not only reached a new high but also demonstrated resilience and growth strength in a continuing challenging market environment. At the same time, the company's successful and sustainable actions are confirmed by ESG awards from renowned rating agencies.

Solid and healthy growth in a challenging environment

The EOS Group is thus consolidating its position as the leading investor in non-performing loans (NPL) in Europe and as an expert in the processing of outstanding receivables. Marwin Ramcke, CEO, and Dr. Eva Griewel, CFO of the EOS Group, attribute this success to the great commitment of all employees and the international culture of innovation. "Our entrepreneurial mindset is our greatest source of motivation. I would like to express my sincere thanks to all our employees," emphasizes Ramcke.

"I am pleased that EOS has once again achieved another strong financial year despite a challenging economic environment. The EOS Group has once again demonstrated its market strength during the financial year through substantial portfolio acquisitions," adds Dr. Griewel.

Strong investments as growth drivers for the economy and the company

The operating result (EBITDA) of EUR 460.8 million in the 2024/25 financial year (previous year: EUR 412.9 million) reflects the very good development of EOS Consolidated. A significant increase in investments in receivables portfolios and excellent operational processing of all acquired portfolios made a major contribution to growth. The investment volume rose to EUR 826.6 million in the reporting year. "We will continue to focus on the purchase of receivables portfolios in the future," explains Ramcke.

The consolidated revenue rose in all regions to EUR 1.1 billion. This represents a 5.6 percent increase compared to the previous year.

Central Europe: Consolidation of forces through new structure

Central Europe, which includes the German market and other growth markets, is the region with the highest revenue share with a contribution of EUR 384.9 million (36.6 percent). "With the restructuring of the regions, we have strengthened international collaboration and leveraged synergies," says Dr. Stephan Ohlmeyer, Managing Director of the EOS Group and responsible for the region Central Europe.

Germany, one of the most important markets for the EOS Group, was able to strengthen its market position again. "This success is largely the result of an impressive team effort. Our courage and determination have been rewarded," Dr. Ohlmeyer continues. The region is also taking important technological steps: the planned introduction of the Kollecto+ collection system in Germany will significantly increase efficiency in receivables management. Another example of digital solutions is the new service portal from EOS in Switzerland, which enables defaulting payers to easily settle their debts via digital self-service.

Eastern Europe: Stable development and strong market presence

The Eastern European region achieved a revenue increase of 7.6 percent and contributed EUR 369.2 million to consolidated revenue. "With the aim of finding fair solutions for defaulting payers and businesses, we have reinforced our market position in Eastern Europe," says Carsten Tidow, member of the Group’s Board of Directors and responsible for Eastern Europe.

The successes in Greece and Poland should be emphasized in particular. Thanks to many years of expertise, significant debt portfolios were acquired in Greece. In Poland, EOS succeeded in expanding its market position in a competitive environment through investments. Strategic partnerships such as the extended cooperation with the International Finance Corporation (IFC) in Bulgaria also strengthen its position in the co-investment sector.

Western Europe: Continuous digitization and high investments

Western Europe exceeded the previous year's revenue by 5.9 percent and contributed EUR 299.1 million to consolidated revenue. "The three pillars of our success in Western Europe is strong investments, operational and digital excellence, and trusting cooperation," comments Sebastian Pollmer, member of the Group’s Board of Directors and responsible for Western Europe.

The developments in Portugal and France are particularly noteworthy. In France, EOS succeeded in making a significant investment in a debt portfolio with a nominal value of over EUR 200 million.

But EOS is also demonstrating its future orientation in the area of digitization: The Kollecto+ collection system developed by EOS itself has already been implemented in eleven countries across the Group and was also rolled out in Belgium at the end of July. Robotic Process Automation (RPA) is already active in more than a dozen countries within the Group with over 140 bots.

Sustainability firmly anchored in the corporate strategy

The EOS Group not only demonstrates financial strength but also continues to place a strong focus on corporate responsibility. "Responsibility shapes all our activities. For example, in line with our Ethical Debtor Management Policy, we maintain a fair and respectful approach towards defaulting payers. However, this encompasses much more, as our ESG ratings demonstrate," explains Marwin Ramcke. At the beginning of 2025, the EOS Group was recognized by the renowned rating agency Morningstar Sustainalytics as "Top Rated Industry" and "Top Rated Regional" for its achievements in the area of environment, social affairs and governance. EOS also received the Bronze Medal from EcoVadis for the first time: "Evidence that we take sustainability seriously, and at the same time, a motivation for us to continue improving," says Ramcke.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on the EOS Group, please go to: eos-solutions.com

Hamburg, Germany, March 12, 2025

- EOS Group received "Top Rated Industry" and "Top Rated Regional" awards from Morningstar Sustainalytics with a 9.9 ESG rating

- The Group is ranked in the top two percent of Diversified Financials globally, showcasing strong ESG commitment

- In addition, the company earned the EcoVadis Bronze Medal

The EOS Group has once again been ranked among the top companies in the consumer finance sector and received the prestigious "Top Rated Industry" and "Top Rated Regional" awards from the rating agency Morningstar Sustainalytics. With an excellent ESG rating score of 9.9, EOS was placed in the best category ("negligible risk", 0-10) on a rating scale of 0 to 40+. These accolades underscore the Group’s continuity and commitment to ongoing development in the areas of environmental, social, and governance (ESG) initiatives. The EOS Group ranks among the top two percent of companies in the Diversified Financials category worldwide.

Furthermore, the group has achieved a commendable initial ESG rating from EcoVadis. EOS is among the top 12 percent sustainable companies in its industry and has been awarded the EcoVadis Bronze Medal.

Motivation to further drive commitment to sustainability

Marwin Ramcke, Chairman of the EOS Group's Board of Directors: “The ratings are a clear demonstration of our commitment to responsible and sustainable business practices and a great motivation for us to continue our efforts. Because, of course, we’re never done!”

Morningstar Sustainalytics is a leading company for ESG research, ratings and data. The ESG risk ratings by Morningstar Sustainalytics measure how well companies manage the main sector-specific ESG risks. ESG stands for Environment, Social and Governance. EcoVadis is a globally recognized provider of sustainability ratings for companies.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on the EOS Group, please go to: https://eos-solutions.com/

Hamburg, Germany, Aug 7, 2024

- EOS Group achieves second highest earnings in 50-year history

- ESG risk rating from Morningstar Sustainalytics: EOS Group one of top 3 in “Consumer Finance” sector

- Corporate Responsibility (CR): EOS publishes second combined annual and sustainability report

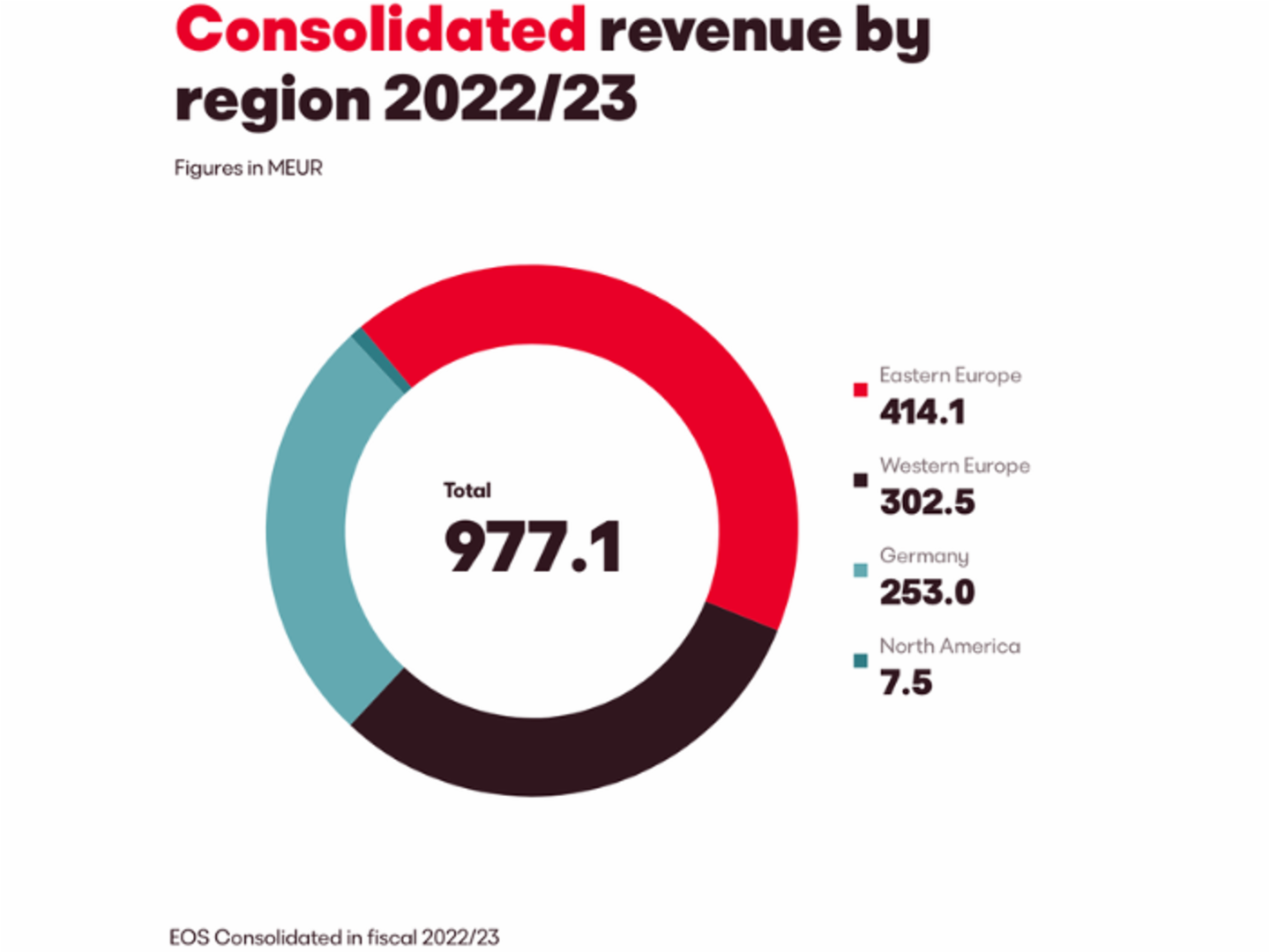

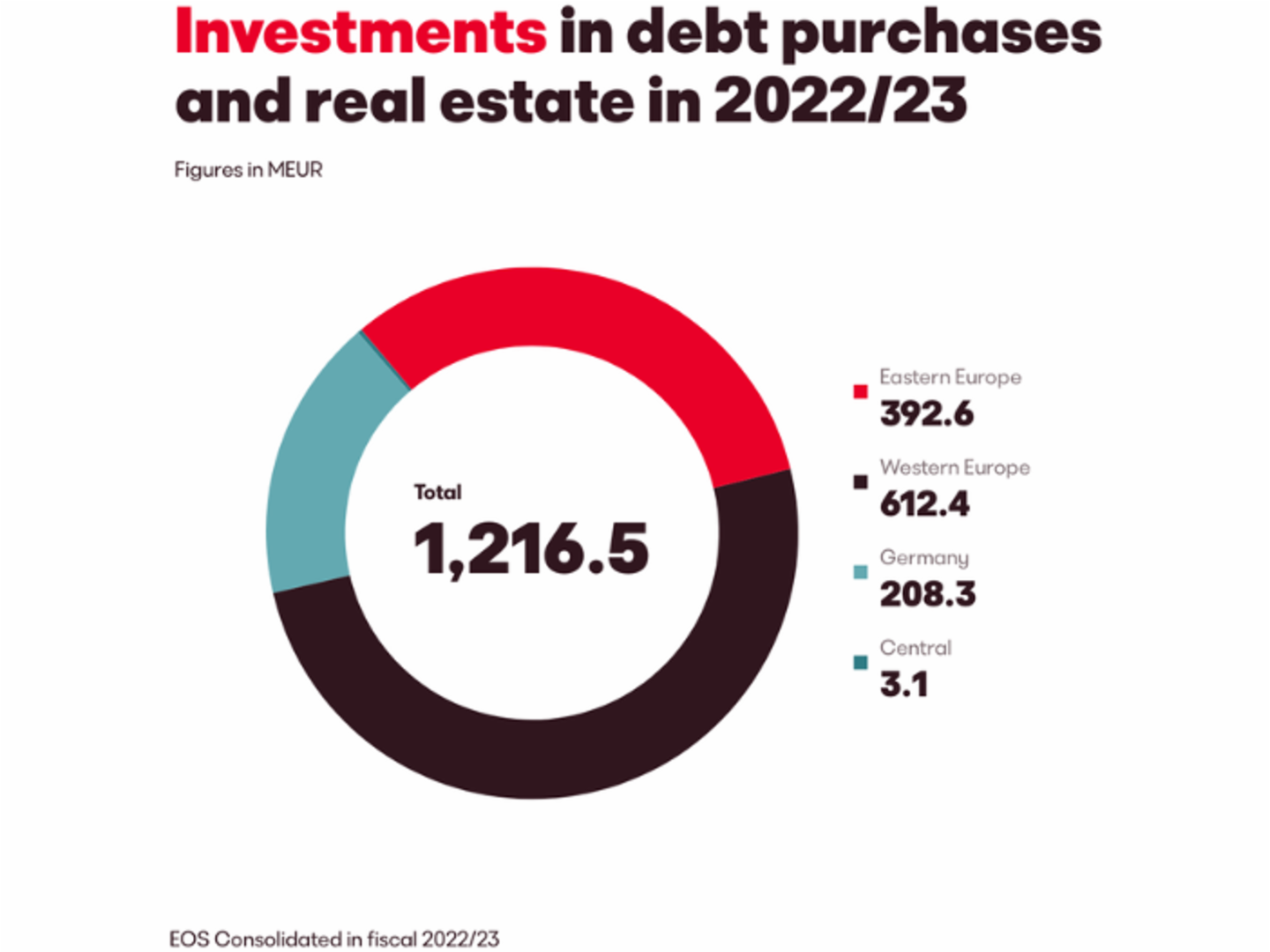

Achieving the second-highest earnings (EBITDA) in the company’s 50-year history – EUR 412.9 million – in the 2023/24 financial year, the EOS Group has sustained a very good level with a 2.1% increase in sales (totaling EUR 997.3 million). At the same time, the investment volume of around EUR 583.5 million was significantly lower than in the exceptional financial year of 2022/23. Successful management of the receivables portfolios acquired in previous years contributed significantly to the overall positive result.

Successful performance despite a challenging economic climate

Despite macroeconomic challenges such as rising interest rates and high inflation, the EOS Group once again succeeded in attaining an impressive EBITDA of over EUR 400 million in the past financial year according to Marwin Ramcke, CEO of the EOS Group. “While the uncertain macroeconomic times are bound to persist, we have nevertheless made dealing with uncertainty at a professional level our strength, have demonstrated our ability to act with resilience and the required flexibility, and are focused on achieving the best solutions for our customers,” Ramcke goes on to say.

The fact that the EOS Group has once again achieved very good earnings despite the difficult macroeconomic situation is due in particular to the outstanding performance of the international teams in recent years, stresses Justus Hecking-Veltman, CFO of the EOS Group at the time the annual financial statements were prepared. Overall, while investments have fallen significantly compared to the exceptional financial year of 2022/23, significant purchases of receivables in the double or triple-digit million range have confirmed the strong market position, Hecking-Veltman adds. “For this reason, the purchase of receivables portfolios will also remain a key focus area of the EOS Group in the future.”

On August 1, 2024, Hecking-Veltman left the company to pursue other challenges. His successor will be Dr. Eva Griewel, who has a PhD in economics.

Eastern Europe slightly exceeds last year’s sales level

With a share of 41.9 percent in overall sales, Eastern Europe is the strongest performing region within the EOS Group. Particularly the companies in Bosnia and Herzegovina, Bulgaria, Greece, and Poland were able to achieve significant increases in sales. Despite rising interest rates, investments amounting to EUR 212.5 million were made. “This is thanks to all our colleagues who have left their comfort zone to break new ground,” says Carsten Tidow, who is responsible for the region of Eastern Europe on the Executive Board.

Western Europe’s growth the strongest with sales up 6.9 percent

At EUR 323.4 million (32.4 percent of total sales), sales in the region of Western Europe increased the most compared to the other regions of the EOS Group (6.9 percent in all). According to Sebastian Pollmer, responsible for the region of Western Europe since the beginning of the 2024/25 financial year, the successful management of existing receivables portfolios is the main reason for this positive development. Deserving special mention is the company in France, whose financial performance has been particularly strong. Together with a co-investor, EOS France purchased a record portfolio with a nominal value of EUR 364 million. The companies in Denmark and Portugal, the latter already established on the market after two short years, have also made a valuable contribution to the increase in sales, Pollmer goes on to say.

Germany at the previous year’s level

On the German market, the EOS Group recorded no changes compared to the previous year, with a 25.5 percent share in sales. The competitive situation is still challenging here. Restructuring measures, such as the newly established region of Central Europe, which Germany has been part of since the start of the 2024/25 financial year, “are beginning to bear fruit,” says Stephan Ohlmeyer, who has been responsible for the new region since March 2024.

Sustainability back in focus

The EOS Group also stood out in the previous financial year for reasons other than its strong business figures. The international group received an outstanding ESG risk rating in 2023. “According to renowned rating agency Morningstar Sustainalytics, EOS is one of the top 3 companies in our ‘Consumer Finance’ sector,” says Marwin Ramcke. “I’m very proud of this rating. Achieving a top position the very first try proves that our corporate responsibility strategy is a success.”

With its annual and sustainability report based on the standards of the Global Reporting Initiative (GRI), EOS makes clear what the Group is achieving in this area. For example, a gender pay gap analysis comparing the salaries of men and women was initiated for the first time. In addition, the company has also calculated its own CO2 footprint (Scope 1 & 2). “We will continue to advance these initiatives during this financial year and derive targeted measures from them, such as for reducing emissions,” Ramcke stresses.

Moreover, the corporate responsibility strategy is firmly anchored in the EOS Group’s core business as well. Responsible debt collection and sustainable debt relief for defaulting consumers are of central interest to EOS. For instance, the Group successfully concluded more than five million debt cases over the last financial year, helping defaulting consumers and returning around EUR 1.9 billion to the economic cycle.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With more than 50 years of experience and offices in over 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of the Otto Group.

For more information on the EOS Group, please go to: https://eos-solutions.com/

The EOS Group is about to make changes to its management team: Justus Hecking-Veltman, CFO and Managing Director of EOS Holding GmbH, will leave the company on August 1, 2024 to take on other challenges. His successor will be Dr Eva Griewel, who holds a doctorate in economics.

Justus Hecking-Veltman, 56, began his career in the Otto Group in 1994 in Group Controlling. In 1998, he moved to OTTO, where he was most recently Director of Controlling and Accounting. He has been Chief Financial Officer of EOS since 2007.

"I would like to thank Justus Hecking-Veltman most sincerely for his successful work as CFO of the EOS Group. He has made a significant contribution to the fact that the Group has grown many times over during his term of office and has reliably generated very high earnings contributions for the Otto Group. I am pleased that Justus Hecking-Veltman will remain associated with the Otto Group and will continue his work as a freelancer on the advisory boards of Frankonia and Systain," says Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources.

Justus Hecking-Veltman sums up: "I can look back on 17 great and successful years at EOS. I would like to thank all my colleagues in the EOS Group and also in the Otto Group for the trusting cooperation and Petra Scharner-Wolff and Alexander Birken for the confidence they have placed in me. At the same time, I wish my successor Dr. Eva Griewel all the best and a lucky hand in her new role."

The successor to the CFO position is very familiar with EOS. Eva Griewel, 46, who holds a PHD in economics, initially started her career at Deloitte. She then worked at EOS from 2008 to 2020, first as an assistant to the CEO and later as SVP of Division Management Western Europe. After taking parental leave, she joined the Hamburg-based Buss Group as CFO in 2022. "I am delighted to be returning to EOS and to have the trust placed in me to continue writing this impressive success story," says Griewel. "There is still a lot of potential in the Group and, together with the team, I would like to make a significant contribution to further profitable growth in these extremely challenging times."

Petra Scharner-Wolff emphasises: "In Dr. Eva Griewel, we have gained an experienced financial expert for the EOS Board of Directors who has known the company for many years. These are the best prerequisites for the continued successful development of the EOS Group.”

About EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on the EOS Group, please go to: eos-solutions.com

- New €275 million facility to purchase and resolve NPLs in Poland

- Project will build resilience of banking sector and foster new lending

- Strong focus on environmental, social and governance aspects

A new €275-million platform in Poland will help financial institutions resolve their non-performing loans (NPLs), freeing up capital for new lending, allowing individuals and businesses to restore their creditworthiness, and bolstering the country’s banking sector.

Co-funded by IFC and EOS Group (EOS), the new facility focuses on the acquisition and resolution of non-performing loans of retail clients, small and medium enterprises, and real estate-owned assets (REOs) held by financial institutions in Poland. The new facility incorporates environmental and social standards into its NPL resolution practices, in line with IFC's Performance Standards. These include objectives such as preventing environmental damage when working with real estate, ensuring borrowers are treated fairly and responsibly.

"Together with our partner IFC, we are delighted to be able to expand our cooperation in the important NPL market in Poland and thus strengthen our activities as a sustainable investor," said Carsten Tidow, Managing Director of the EOS Group and responsible for Eastern Europe. "As one of the largest and most active NPL markets in Eastern Europe, Poland is a particular focus for EOS. In addition to the positive contribution to the Polish economy, the consideration of environmental, social and governance aspects continues to play a major role in the selection and resolution of NPLs."

The new facility is part of IFC’s Distressed Asset Recovery Program (DARP), which focuses on the acquisition and resolution of distressed assets across emerging markets. The $9.1 billion global investment program includes commitments of $3.2 billion on IFC’s account and $5.9 billion mobilized from private sector investors.

The project will be the third engagement of IFC and EOS, following the creation of a facility in 2010 to purchase and resolve unsecured retail NPL portfolios, and a €129 million regional facility to help financial institutions resolve their NPLs in Bosnia and Herzegovina, Croatia, Romania, and Serbia in 2022.

"IFC is a market leader in distressed asset acquisition and resolution in emerging markets,” said Ariane di Iorio, Global Head of Distressed Assets Investments at IFC. “By supporting distressed assets markets in our target countries sustainably and ethically, we help financial institutions return to their core lending businesses and normalize NPLs so borrowers can become creditworthy again.”

“Ethical debt collection has always been at the core of our business, thus integrating sustainable investment into our processes is a natural next step,” said Dariusz Petynka, Managing Director of EOS Poland. EOS has been active in the NPL market in Poland for over 25 years. “Over the past few years, we have been fortunate to make very significant investments in NPL portfolios in Poland. The cooperation with IFC will allow us to strengthen our position as one of the leading players in the Polish market,” said Borys Drajczyk, Member of the Management Board, Chief Investment and Technology Officer at EOS Poland.

About IFC

IFC — a member of the World Bank Group — is the largest global development institution focused on the private sector in emerging markets. We work in more than 100 countries, using our capital, expertise, and influence to create markets and opportunities in developing countries. In fiscal year 2023, IFC committed a record $43.7 billion to private companies and financial institutions in developing countries, leveraging the power of the private sector to end extreme poverty and boost shared prosperity as economies grapple with the impacts of global compounding crises. For more information, visit www.ifc.org

About EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group. For more information on the EOS Group, please go to: eos-solutions.com

About EOS Poland

EOS Poland is a team of experts specializing in the purchase and management of receivables. Using modern technological solutions, we provide financial services tailored to the needs of both our business partners and defaulting payers. We help to recover debts effectively, professionally and with due respect for ethical principles. We have been present on the Polish market since 1998. As a member of the Association of Financial Enterprises in Poland, we operate in accordance with the Good Practice Principles. For more information on EOS Poland, please go to: eos-poland.pl

Veld Capital, a leading European specialist private credit investor, together with the EOS Group, are delighted to announce the purchase of a portfolio of regulated French consumer loans from BNP Paribas Personal Finance. The €364 Million (nominal value) portfolio is highly granular in nature, containing over 125,000 small balance French consumer loans with an average balance of under €3,000.

The portfolio acquired has strong, stable cash flow from amortising loans with affordable monthly payments and a weighted average seasoning of over two years. As a result of these characteristics, the underlying assets demonstrate high payment predictability and stability. The assets were purchased outright by a securitisation vehicle funded jointly by Veld and EOS, with the servicing being migrated to EOS for management.

Following this transaction, Veld and EOS have further strengthened their operating partnership, having previously co-invested together in a number of European jurisdictions and asset types. EOS France, a subsidiary of the international EOS Group, is a leading expert in the purchase and servicing of receivables portfolios with more than 30 years of experience within the French market.

The portfolio was acquired from BNP Paribas Personal Finance, a wholly owned subsidiary of the BNP Paribas Group, and a major consumer finance player in both France and Europe, offering a wide range of consumer credit products.

Leveraging extensive relationships and product expertise developed as a solutions provider to European banks over its 14-year history, Veld (previously AnaCap Credit) primarily targets granular, amortising and asset-backed investment opportunities, benefiting from data-rich underwriting where it can utilise internal expertise as well as comparable proprietary data. Approximately 80% of Veld’s investments since inception have been with banks and financial institutions as counterparties, often as part of repeat transactions, providing credibility and transaction certainty.

Nathalie Lameyre, Chief Executive Officer at EOS France, commented:

“We are very happy to have been able to finalise, with the support of Veld, the largest sale of consumer credit receivables ever carried out in France. This success is the result of many years of partnership and trust between BNP Paribas Personal Finance and EOS, in Europe and particularly in France.”

Konstantin Karchinov, Partner at Veld Capital, added:

“It has been a pleasure to be involved in this transaction, the Fund’s first investment in French consumer loans. Both the French market and our strong relationship with EOS are key sources of high potential opportunities in 2024 as Veld launches its fifth flagship Credit Opportunities fund.”

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With over 50 years of experience and offices in more than 20 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

About Veld Capital

Established in 2009 as the credit investment arm of AnaCap Financial Partners, Veld Capital initially targeted non-core assets from financial institutions across Europe. Consistently an early mover across geographies and asset types, today Veld Capital targets a broad range of highly cash generative and asset-backed investments.

Veld Capital seeks out exceptional opportunities by combining localised origination, underwriting and asset management expertise to provide solutions in the mid-market. Our credit-oriented investment philosophy is underpinned by a rigorous, data driven approach to underwriting, preservation of capital and actively engaged asset management.

Since 2009, Veld Capital has raised ~€2.7bn of capital across its flagship Credit Opportunities, Real Estate and permanent capital vehicles from a growing base of highly reputable institutional investors globally. www.veldcap.com

Hamburg, Germany, December 15, 2023

The EOS Group has won two Red Dot Awards 2023 in the Corporate Design and Typography categories. In spring 2022, the international financial services provider unveiled its new brand identity, which has now been honoured.

"We are thrilled to receive this award. The Red Dot Award is an incredible acknowledgement of our work," says Lara Flemming, Senior Vice President Communications & Marketing at EOS Holding GmbH. " Many of our colleagues made the relaunch possible and contributed to the successful transformation of our brand. This award belongs to them all."

The clear and dynamic design positions EOS at various touchpoints as a modern player in the European receivables management market. "We actively create change at EOS. With the relaunch, it was therefore crucial to show this attitude visually," says Lara Flemming.

The rollout of the new brand was made possible in various workstreams with colleagues in 24 countries. EOS received support for the brand relaunch from the Hamburg-based design agency Syndicate.

The Red Dot is one of the most prestigious awards for design quality. The international jury of the Red Dot Award Brands & Communication Design only awards this seal of quality to projects that impress them with their good design quality and creative performance in various categories. Further information on the award-winning EOS design projects: www.red-dot.org/eos-holding

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

- Excellent ESG risk rating validates EOS Group’s sustainability strategy

- EOS is among the top two percent in its own segment

- First external rating to assess sustainability risks by rating agency Morningstar Sustainalytics

For the first time, the EOS Group received an ESG rating from the renowned rating agency Morningstar Sustainalytics. The financial services provider and investor was given a risk rating of 10.2 (low risk). According to Morningstar Sustainalytics, this puts EOS among the top two percent in the “Consumer Finance” sector in which it operates.

EOS was assessed in the categories “Human Capital”, “Product Governance”, “Data Privacy and Security”, “Corporate Governance” and “Business Ethics”. At 10.2, EOS only just fell short of the best category (0 to 10, negligible risk) on a rating scale of 0 to 40+.

“Become a little better every day”

“We want to change things for the better, day by day. This independent ESG rating makes our contribution to sustainable development transparent,” says Marwin Ramcke, CEO of the EOS Group. “Getting this top position right away shows that our corporate responsibility strategy is successful and that we are very well positioned in a lot of areas. This result is also an incentive to continue to become a little better every day,” Ramcke continues.

Transparency for more sustainability

Morningstar Sustainalytics is a leading company for ESG research, ratings and data. The ESG risk ratings by Morningstar Sustainalytics measure how well companies manage the main sector-specific ESG risks. ESG stands for Environment, Social and Governance.

Not only did EOS receive a sustainability rating from a rating agency for the first time this year, it also published a combined annual and sustainability report according to the Global Reporting Initiative (GRI) standard.

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on the EOS Group, please go to: eos-solutions.com

For more details on the rating and the methodology applied, go to: https://www.sustainalytics.com/esg-rating/eos-holding-gmbh/2000170330

Hamburg, Germany, October 24, 2023

In the course of its successful internationalization strategy, EOS Holding GmbH, Hamburg, is reorganizing its regional responsibilities: At the beginning of the coming financial year on 1 March 2024, the German market will be merged into the new Central Europe region. In addition to Eastern and Western Europe, this will create another high-growth region with the markets of Germany, Austria, Switzerland, Slovakia, Slovenia, the Czech Republic and Hungary.

In the course of this restructuring, a number of changes have been decided in the management team of the Otto Group's financial services provider: Dr. Stephan Ohlmeyer (55), a proven financial expert and insider of the industry, will join the Group on 1 November 2023. After a four-month handover period by the current Managing Director of Germany, Andreas Kropp (56), Ohlmeyer will take over the region Central Europe. After around 20 years in various management positions at the Otto Group, Andreas Kropp will in future be taking on new tasks outside the EOS Group at his own request.

"We would like to thank Andreas Kropp for his many years of commitment to EOS in a highly developed, important market for the Group," says Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources at the Otto Group. "Now the task is to build up the Central Europe region. With Dr. Stephan Ohlmeyer, we have found the ideal person for this task at EOS. He has been a companion in the industry for many years. His view from the outside together with his outstanding expertise as a financial expert bring new impulses at the right time."

Dr Stephan Ohlmeyer is regarded as an internationally renowned portfolio manager. After holding positions at Goldman Sachs, Morgan Stanley, Lone Star and investment firms such as Intrum and Hoist, he wants to bring his expertise to the company for the next growth steps. "Ideal conditions were created for me to join the company: With the support of Andreas Kropp and the board colleagues from Western and Eastern Europe, I can build up the necessary internal know-how for the various markets in the coming months. Together with my international experience, we will quickly move the Central Europe region forward," says Ohlmeyer.

Further changes in the top management of the Group will also be implemented on 1 March 2024: The Managing Director of the Western Europe region, Dr. Andreas Witzig will leave the Executive Board at the end of the financial year after 17 years. The 57-year-old lawyer looks back on a career of around 20 years in leading positions in the Otto Group.

"Dr. Andreas Witzig has been able to develop the Western Europe region excellently over the past years. I would like to thank him very much for this. With Sebastian Pollmer, a great talent of the younger generation is taking over who has already become intensively acquainted with the markets", explains Petra Scharner-Wolff, Group Executive Board Member for Finance, Controlling and Human Resources of the Otto Group.

Sebastian Pollmer, Senior Vice President for the Region, will succeed as the new Managing Director of the Western Europe Region. The 39-year-old has gained outstanding expertise in the field of NPL transactions and evaluations after holding positions at Norddeutsche Landesbank and KPMG since 2016. "I am very pleased about the trust placed in me. There is still a lot of potential in the Western Europe region. From March 2024, my team and I will focus primarily on leveraging precisely this potential, especially in the area of digitalisation," he says.

"In these rapidly changing times and numerous uncertainties in the economy and politics, it is becoming increasingly important to consistently adapt as a company and to map diverse skills in the management team," Scharner-Wolff summarises. "I am convinced that with the current changes we are taking the right development step into the future, which will ensure the success of the Otto Group."

About the EOS Group

The EOS Group is a leading technology-driven investor in receivables portfolios and an expert in the processing of outstanding receivables. With around 50 years of experience and offices in 24 countries, EOS offers smart services for receivables management worldwide. Its key target sectors are banking, real estate, telecommunications, utilities, and e-commerce. EOS employs more than 6,000 people and is part of Otto Group.

For more information on EOS Group, please go to: eos-solutions.com

Press contact

Lara Flemming

Senior Vice President Corporate Communications & Marketing

EOS Holding GmbH

Corporate Communications & Marketing

Steindamm 71

20099 Hamburg

Sarah El Jobeili

Corporate Communications & Marketing EOS Group

EOS Holding GmbH

Corporate Communications & Marketing

Steindamm 71

20099 Hamburg

Germany