Hamburg, Germany, July 26, 2023

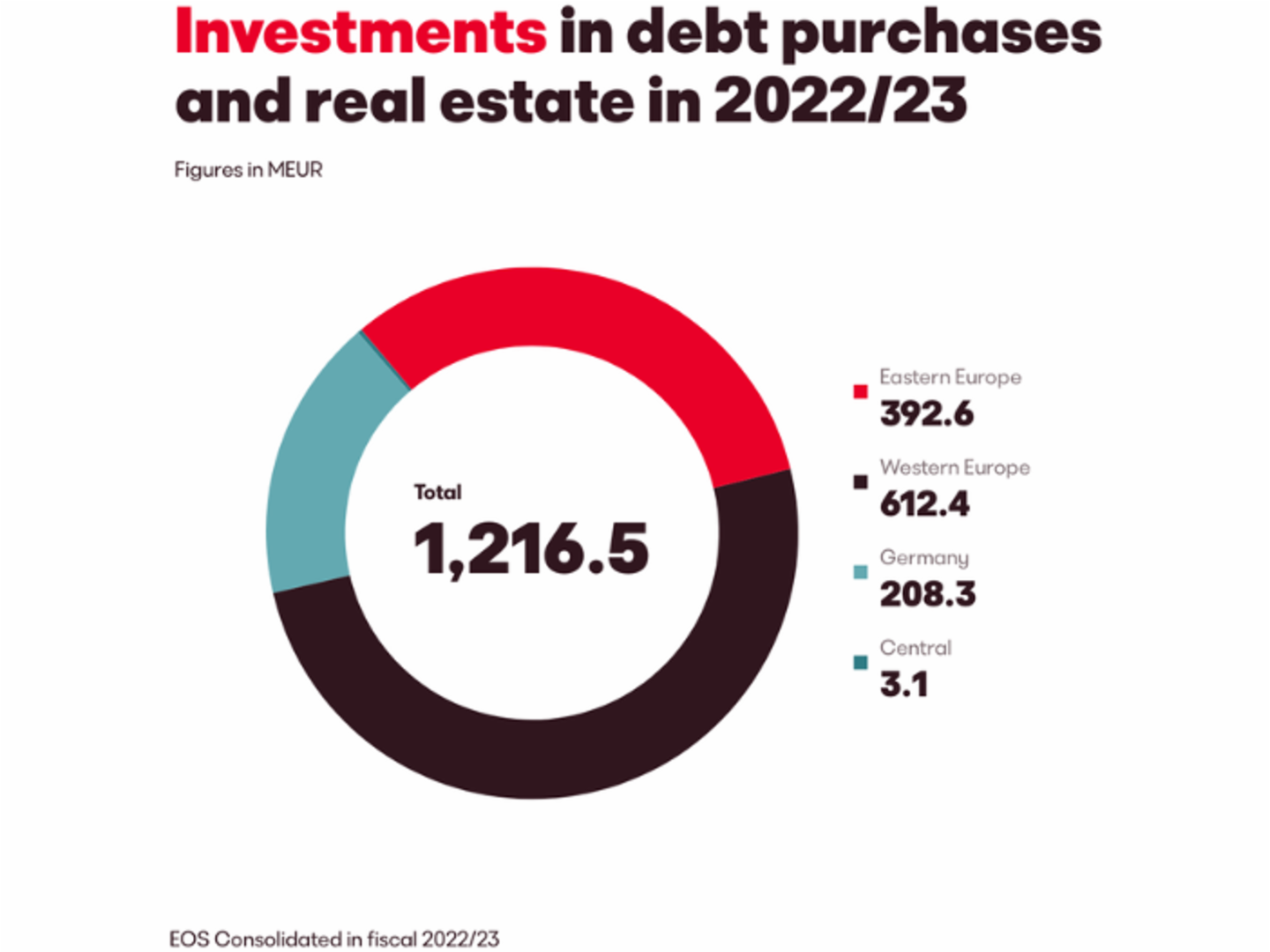

- Significant increase in investment volume in Eastern and Western Europe

- Even stronger focus on international collaboration and digitalization

- Corporate Responsibility (CR): Combined Annual and Sustainability Report based on Global Reporting Initiative (GRI) standards for first time

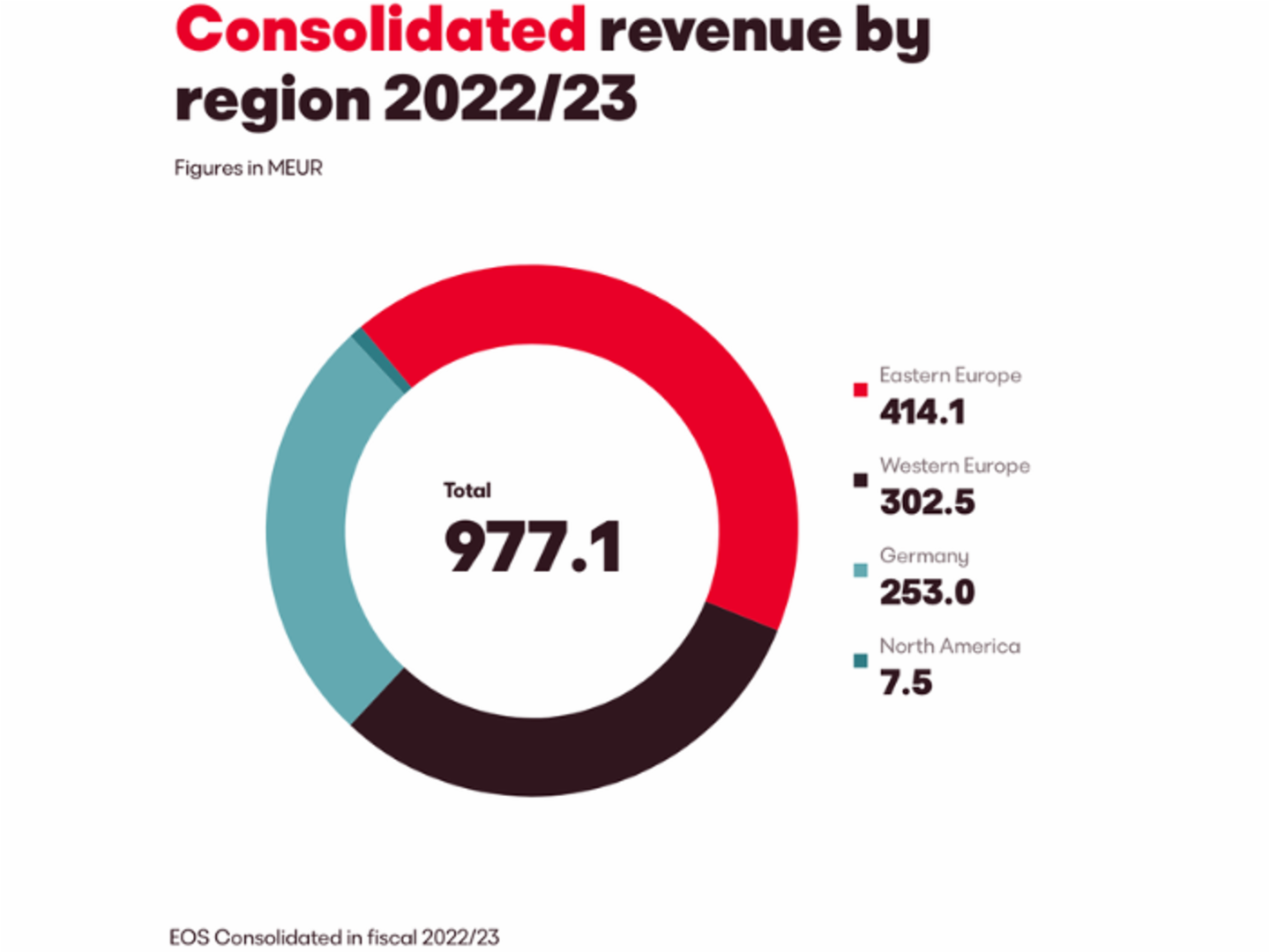

The EOS Group enjoyed strong growth in the 2022/23 financial year. Europe’s leading investor in non-performing loans, debt and real estate portfolios, and expert in the processing of outstanding receivables, achieved an EBITDA of EUR 445.9 million in fiscal 2022/23. A major factor in this success was the significant increase in investment volume of EUR 668.6 million (in the previous year) to EUR 1.2 billion, with EOS investing in both secured and unsecured receivables.